Embark on a comprehensive journey through the realm of liability coverage for small business owners, unraveling the complexities and nuances that define this crucial aspect of financial protection.

Delve into the intricacies of different types of liability coverage, factors influencing choice, costs involved, and pitfalls to avoid.

Understanding Liability Coverage

Liability coverage is a type of insurance that protects small business owners from financial losses that may arise due to legal claims or lawsuits filed against their business. It provides coverage for legal expenses, settlements, and judgments that the business may be required to pay.

Examples of Situations Requiring Liability Coverage

- A customer slips and falls on your business premises, leading to a lawsuit for medical expenses and damages.

- An employee makes a mistake that results in financial losses for a client, leading to a lawsuit for negligence.

- Your product causes harm or injury to a consumer, resulting in a product liability claim.

The Importance of Liability Coverage for Small Businesses

Liability coverage is essential for small businesses as it helps protect them from the potentially devastating financial consequences of legal actions. Without adequate coverage, a single lawsuit could bankrupt a small business and put its assets at risk. Having liability coverage in place provides peace of mind and financial security for business owners, allowing them to focus on growing their business without the constant fear of litigation.

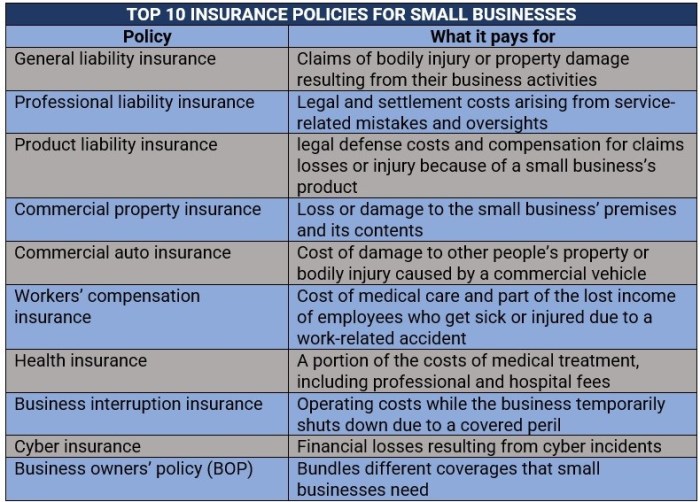

Types of Liability Coverage

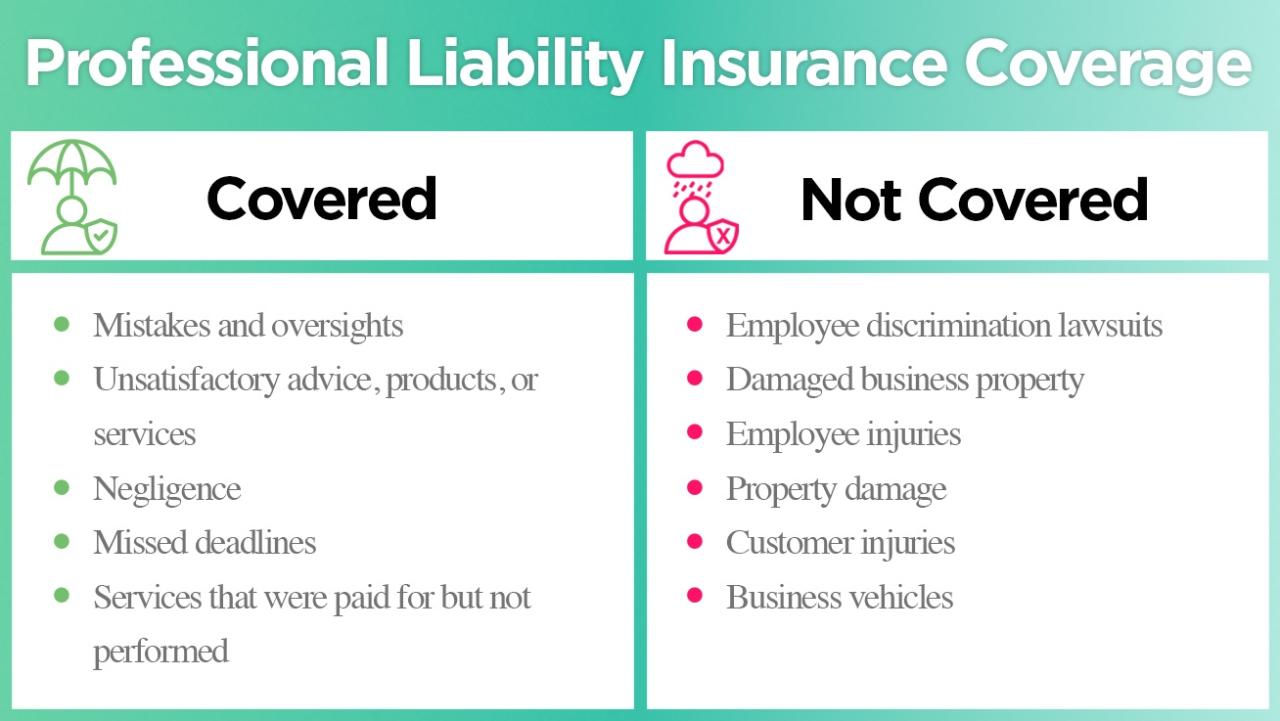

When it comes to protecting your small business from potential risks and legal claims, there are several types of liability coverage available. Each type offers specific coverage areas and benefits tailored to different aspects of your business.

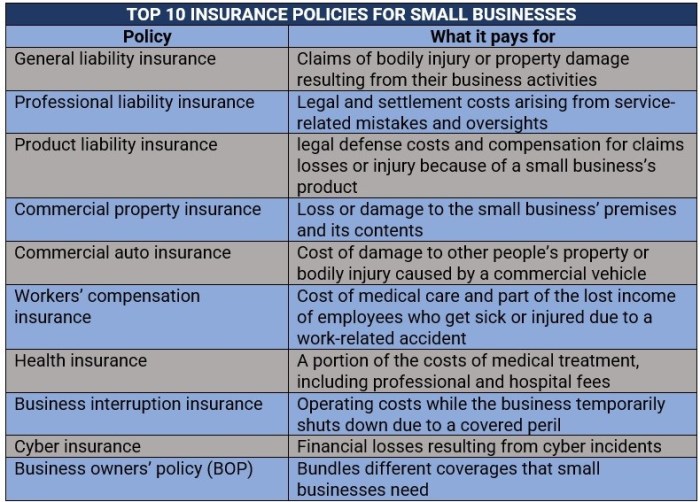

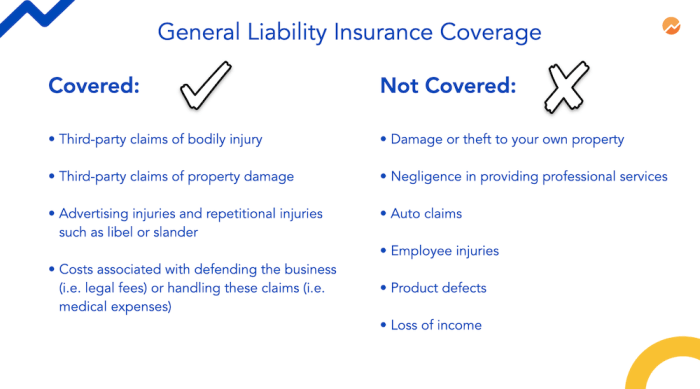

General Liability

General liability insurance is essential for small business owners as it provides coverage for third-party bodily injury, property damage, and advertising injury claims. For example, if a customer slips and falls in your store or if your product causes damage to someone's property, general liability insurance would cover the costs associated with these claims.

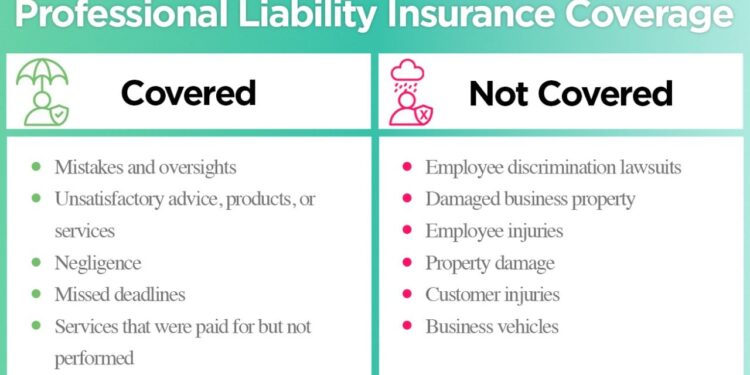

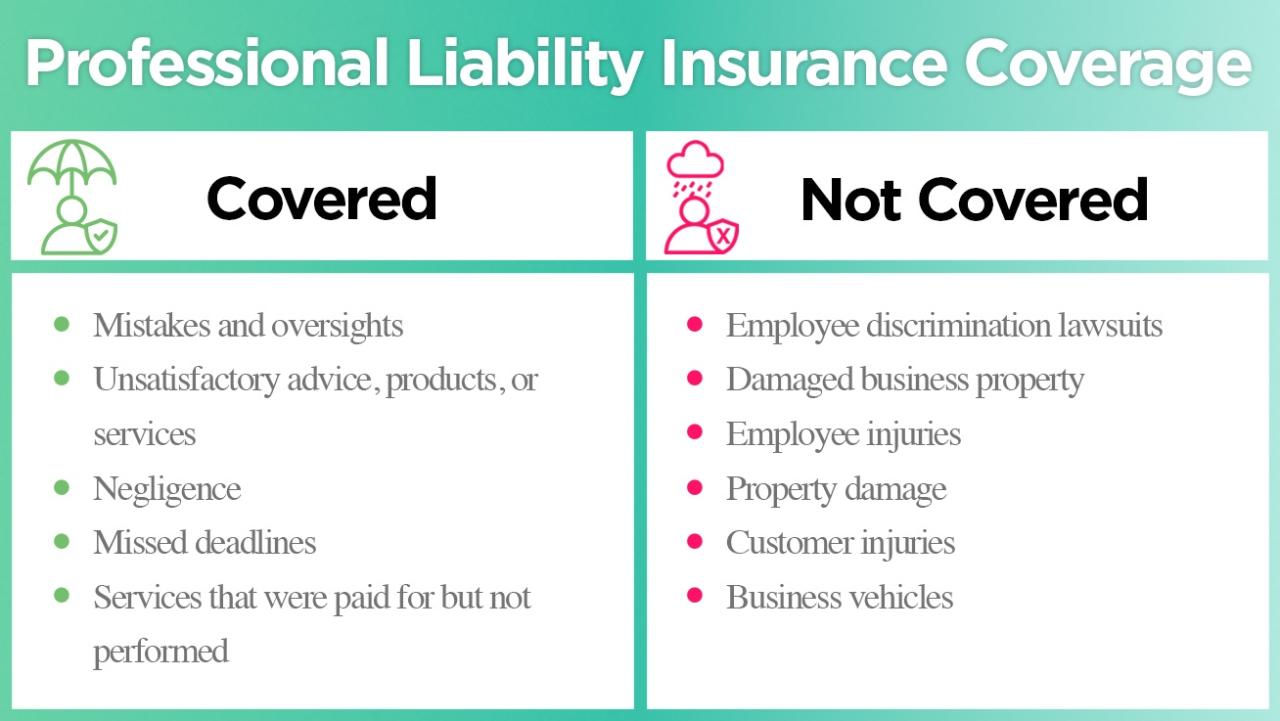

Professional Liability

Professional liability insurance, also known as errors and omissions insurance, is crucial for businesses that provide services or professional advice. This type of coverage protects you from claims of negligence, errors, or omissions in your work. For instance, if a client sues you for financial losses due to a mistake in your professional services, professional liability insurance would help cover legal fees and settlements.

Product Liability

Product liability insurance is essential for businesses that manufacture, distribute, or sell products. This coverage protects you from claims related to injuries or damages caused by your products. For example, if a customer gets sick from consuming your food product or if a defective product causes harm, product liability insurance would cover the costs associated with these claims.

Factors to Consider When Choosing Liability Coverage

When selecting liability coverage for their small businesses, owners need to take into account several key factors to ensure they have the appropriate protection in place.

Business Type and Industry

The type of business you operate and the industry you are in can greatly impact the type of liability coverage you need. For example, a retail business may face different risks compared to a construction company. It's essential to choose coverage that aligns with the specific risks associated with your industry.

Risk Exposure

Understanding the level of risk exposure your business faces is crucial when deciding on liability coverage. Factors such as the number of employees, the type of products or services offered, and the location of your business can all contribute to your risk profile.

It's important to assess these factors carefully to determine the level of coverage needed.

Size and Structure of the Business

The size and structure of your business can also influence your choice of liability coverage. A sole proprietorship may have different coverage needs compared to a larger corporation with multiple employees

. Consider the size of your business, the revenue it generates, and the assets at risk when determining the appropriate level of coverage.

Determining the Appropriate Coverage Level

To determine the right level of liability coverage for your business, consider factors such as your annual revenue, the value of your assets, and the potential costs of legal claims. It's essential to strike a balance between adequate coverage and affordability.

Consulting with an insurance professional can help you assess your needs and select the right coverage options.

Cost of Liability Coverage

Understanding how the cost of liability coverage is determined is crucial for small business owners looking to protect their assets and mitigate risks. The cost can vary depending on various factors, such as the type of business, coverage limits, location, and claims history.

Factors Influencing Cost

Several factors contribute to the cost of liability coverage for small businesses, including:

- The type of business and associated risks.

- The coverage limits and deductible chosen.

- The location of the business and local regulations.

- The claims history of the business.

Strategies to Manage Costs

Small business owners can implement the following strategies to manage and reduce the costs of liability coverage:

- Regularly review and reassess coverage needs to ensure it aligns with the business's current operations.

- Implement risk management practices to reduce the likelihood of claims.

- Consider bundling multiple policies with the same insurer for potential discounts.

- Shop around and compare quotes from different insurers to find the most cost-effective option.

Cost-Effective Ways to Secure Adequate Coverage

Small business owners can secure adequate liability coverage without overspending by:

- Opting for a Business Owner's Policy (BOP) that combines multiple coverages at a lower cost.

- Choosing a higher deductible to lower premium costs, if financially feasible.

- Working with an experienced insurance agent to find tailored coverage options that fit the business's needs and budget.

Common Mistakes to Avoid with Liability Coverage

When it comes to liability coverage, small business owners often make mistakes that can have serious consequences. It's essential to be aware of these common pitfalls to ensure your business is properly protected.

Underestimating Coverage Needs

One common mistake is underestimating the amount of liability coverage needed for your business. This can leave you vulnerable to lawsuits and financial loss if an incident occurs that exceeds your coverage limits. It's important to assess your risks carefully and work with an insurance professional to determine the appropriate level of coverage.

Choosing the Cheapest Option

Opting for the cheapest liability coverage option may seem like a cost-effective choice, but it can lead to inadequate protection. Cheap policies often have limited coverage and exclusions that may not fully protect your business in case of a claim.

It's crucial to prioritize comprehensive coverage over price when selecting a policy.

Ignoring Industry-Specific Risks

Another mistake is overlooking industry-specific risks that your business may face. Each industry has unique liabilities and exposures that require tailored coverage. Failing to address these specific risks can leave gaps in your coverage, making your business vulnerable to lawsuits and financial harm.

Not Reviewing Coverage Regularly

Many small business owners set up liability coverage and then forget about it. It's essential to review your coverage regularly to ensure it still meets the needs of your business. As your business grows or changes, your liability risks may also evolve, requiring adjustments to your coverage.

Assuming General Liability is Enough

Some business owners make the mistake of assuming that general liability insurance is sufficient to protect their business. While general liability provides broad coverage, it may not address all potential risks your business faces. Consider additional types of liability coverage, such as professional liability or cyber liability insurance, to ensure comprehensive protection.

Last Word

In conclusion, this guide equips small business owners with the knowledge and insights necessary to navigate the intricate landscape of liability coverage, ensuring their ventures are safeguarded against potential risks and liabilities.

FAQ

What factors should small business owners consider when selecting liability coverage?

Small business owners should consider factors like business type, industry, and risk exposure to choose appropriate coverage.

How is the cost of liability coverage determined for small businesses?

The cost of liability coverage is determined based on factors like business size, industry risks, and coverage limits.

What are some cost-effective ways to secure adequate liability coverage?

Small business owners can explore options like bundling policies, raising deductibles, or adjusting coverage limits to manage costs effectively.

Embark on a comprehensive journey through the realm of liability coverage for small business owners, unraveling the complexities and nuances that define this crucial aspect of financial protection.

Delve into the intricacies of different types of liability coverage, factors influencing choice, costs involved, and pitfalls to avoid.

Embark on a comprehensive journey through the realm of liability coverage for small business owners, unraveling the complexities and nuances that define this crucial aspect of financial protection.

Delve into the intricacies of different types of liability coverage, factors influencing choice, costs involved, and pitfalls to avoid.

When selecting liability coverage for their small businesses, owners need to take into account several key factors to ensure they have the appropriate protection in place.

When selecting liability coverage for their small businesses, owners need to take into account several key factors to ensure they have the appropriate protection in place.

Understanding how the cost of liability coverage is determined is crucial for small business owners looking to protect their assets and mitigate risks. The cost can vary depending on various factors, such as the type of business, coverage limits, location, and claims history.

Understanding how the cost of liability coverage is determined is crucial for small business owners looking to protect their assets and mitigate risks. The cost can vary depending on various factors, such as the type of business, coverage limits, location, and claims history.