Exploring Automotive Insurance Quotes: What’s Included and What’s Not sets the stage for a comprehensive dive into the intricacies of insurance coverage, shedding light on what to expect and what to look out for.

The following paragraphs will delve into the key components of automotive insurance quotes, shedding light on both inclusions and exclusions that can impact your coverage decisions.

Understanding Automotive Insurance Quotes

When it comes to understanding automotive insurance quotes, there are several key components to consider. These include the coverage options, factors that influence the cost of insurance, and how deductibles can impact premiums. Let's delve into these aspects in more detail:

Components of Automotive Insurance Quotes

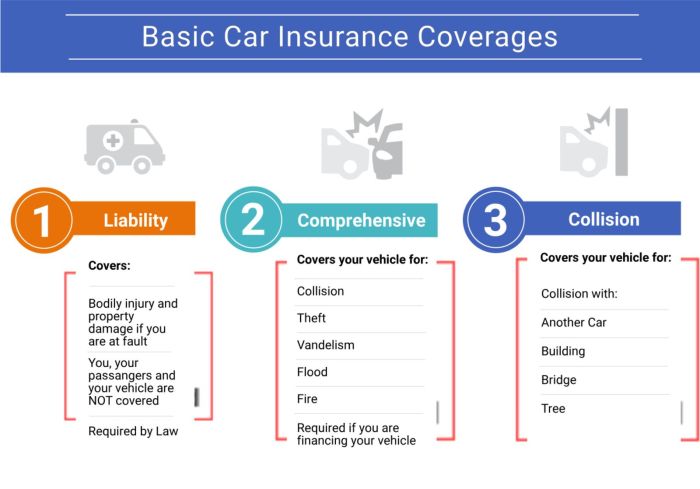

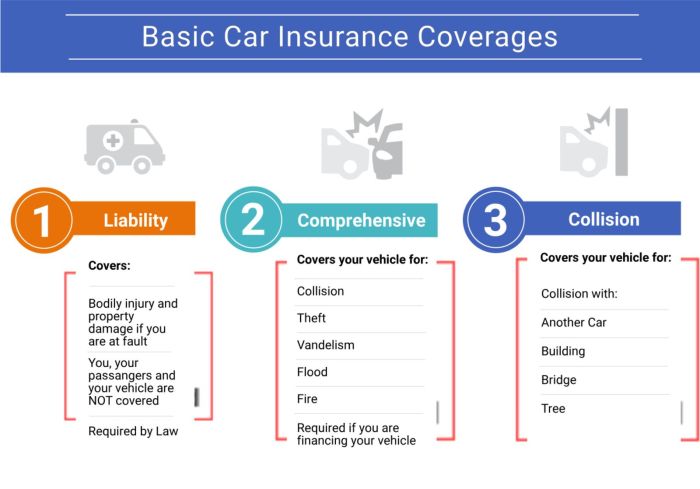

- Liability Coverage: This covers bodily injury and property damage that you may cause to others in an accident.

- Collision Coverage: This pays for damage to your own vehicle in the event of a collision.

- Comprehensive Coverage: This covers damage to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're in an accident with a driver who has insufficient or no insurance.

Factors Influencing Automotive Insurance Cost

- Driving Record: A clean driving record typically results in lower premiums.

- Vehicle Type: The make, model, and age of your vehicle can impact insurance costs.

- Location: Where you live and park your car can affect your insurance rates.

- Coverage Limits: Higher coverage limits lead to higher premiums.

Types of Coverage Options

- Basic Coverage: Includes liability coverage and is the minimum required by law in most states.

- Full Coverage: Combines liability, collision, and comprehensive coverage for more extensive protection.

- Gap Insurance: Covers the difference between what you owe on a car loan and the car's current value in case of a total loss.

Impact of Deductibles on Premiums

Increasing your deductible can lower your insurance premium, but it also means you'll pay more out of pocket in the event of a claim. For example, if you have a $500 deductible and file a claim for $1,000 in damages, you would pay $500, and your insurance would cover the remaining $500.

Inclusions in Automotive Insurance Quotes

When looking at automotive insurance quotes, it is essential to understand what is included in the coverage to ensure you are adequately protected in case of an accident or other unforeseen events. Here we will delve into the key inclusions in automotive insurance quotes to help you make an informed decision.

Liability Insurance Coverage

Liability insurance is a crucial component of automotive insurance quotes as it provides coverage for damages or injuries you may cause to others in an accident. This coverage typically includes property damage and bodily injury liability, helping to protect you financially in case you are at fault in a collision.

Collision Coverage

Collision coverage is another important inclusion in automotive insurance quotes, as it helps cover the cost of repairing or replacing your vehicle if it is damaged in a collision with another vehicle or object. This coverage is especially valuable for newer vehicles or those with a higher value, providing financial protection in case of an accident.

Comprehensive Coverage

Comprehensive coverage is designed to protect your vehicle from non-collision related incidents, such as theft, vandalism, or natural disasters. This inclusion in automotive insurance quotes can provide peace of mind knowing that your vehicle is covered in a variety of scenarios beyond just accidents on the road.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments Coverage are additional inclusions in automotive insurance quotes that help cover medical expenses for you and your passengers in case of an accident. PIP typically covers a broader range of expenses, including lost wages and rehabilitation costs, while Medical Payments Coverage focuses specifically on medical bills resulting from an accident.By understanding the inclusions in automotive insurance quotes, you can better assess your coverage needs and select a policy that provides the protection you require on the road.

Exclusions in Automotive Insurance Quotes

When getting automotive insurance quotes, it's crucial to understand what is included in your policy. Equally important is to be aware of what is not covered. Exclusions in automotive insurance quotes refer to specific situations or damages that may not be included in your policy

.

Let's explore common exclusions and optional add-ons that you may need to consider.

Common Exclusions in Standard Automotive Insurance Policies

- Intentional Damage: Damages caused intentionally by the policyholder are typically not covered.

- Racing Activities: Damages that occur while engaging in racing activities or competitions.

- Wear and Tear: Regular wear and tear on your vehicle is usually not covered.

- Unapproved Drivers: If an unapproved driver causes an accident, it may not be covered.

Scenarios Where Certain Damages May Not be Covered

- Natural Disasters: Some policies may exclude coverage for damages caused by natural disasters like floods or earthquakes.

- Uninsured Motorist: In cases where the other driver is uninsured, your policy may not cover all damages.

- Commercial Use: If your vehicle is used for commercial purposes, certain damages may not be covered.

Optional Coverage Add-Ons

- Rental Car Coverage: Provides reimbursement for a rental car while your vehicle is being repaired.

- Roadside Assistance: Offers help for roadside emergencies like flat tires or breakdowns.

- GAP Insurance: Covers the difference between the actual cash value of your vehicle and the amount you owe on a loan or lease.

Examples of Exclusions That May Vary Between Insurance Providers

- Custom Parts and Equipment: Some insurers may exclude coverage for aftermarket upgrades unless specified.

- Parking Tickets: Certain policies may not cover damages if your vehicle was parked illegally.

- DUI Incidents: Coverage for damages resulting from driving under the influence may vary among providers.

Factors Influencing Automotive Insurance Quotes

When it comes to determining automotive insurance quotes, several factors come into play. These factors can significantly impact the premium you pay for your coverage. Let's explore the key elements that influence automotive insurance quotes.

Driver’s Age, Driving Record, and Location

- The driver's age: Younger drivers typically face higher insurance premiums due to their lack of driving experience and higher likelihood of accidents. Older, more experienced drivers tend to receive lower quotes.

- Driving record: A clean driving record with no accidents or traffic violations can result in lower insurance quotes, as it indicates a lower risk for insurance companies.

- Location: The area where you live can also impact your insurance quotes. Urban areas with higher rates of accidents or theft may lead to higher premiums compared to rural areas with lower risk factors.

Vehicle’s Make, Model, and Age

- Make and model: The type of vehicle you drive plays a significant role in determining insurance premiums. Expensive or high-performance cars may result in higher quotes due to increased repair costs and theft rates.

- Age of the vehicle: Older cars may have lower insurance premiums compared to newer models, as they are typically less expensive to repair or replace.

Credit Score and Insurance History

- Credit score: Insurance companies may consider your credit score when calculating insurance quotes. A higher credit score can lead to lower premiums, as it is often associated with responsible financial behavior.

- Insurance history: Your past insurance claims and history of coverage can impact your current insurance quotes. A history of frequent claims may result in higher premiums.

Bundling Policies and Deductibles

- Bundling policies: Combining multiple insurance policies, such as auto and home insurance, with the same provider can often lead to discounts on premiums, reducing overall costs.

- Higher deductibles: Opting for a higher deductible means you'll pay more out of pocket in the event of a claim, but it can also result in lower insurance premiums. However, it's essential to weigh the cost savings against the potential financial risk.

Wrap-Up

In conclusion, Automotive Insurance Quotes: What’s Included and What’s Not serves as a valuable guide in navigating the complex world of insurance, empowering you to make informed choices that suit your needs and budget.

Question Bank

What factors influence the cost of automotive insurance?

The driver's age, driving record, location, vehicle make and model, credit score, and insurance history all play a role in determining insurance costs.

What are common exclusions in standard automotive insurance policies?

Exclusions can include intentional damage, racing, driving under the influence, and using the vehicle for commercial purposes.

Is personal injury protection (PIP) included in automotive insurance quotes?

Yes, PIP coverage is often included in automotive insurance quotes to provide medical coverage for the insured driver.

Exploring Automotive Insurance Quotes: What’s Included and What’s Not sets the stage for a comprehensive dive into the intricacies of insurance coverage, shedding light on what to expect and what to look out for.

The following paragraphs will delve into the key components of automotive insurance quotes, shedding light on both inclusions and exclusions that can impact your coverage decisions.

Exploring Automotive Insurance Quotes: What’s Included and What’s Not sets the stage for a comprehensive dive into the intricacies of insurance coverage, shedding light on what to expect and what to look out for.

The following paragraphs will delve into the key components of automotive insurance quotes, shedding light on both inclusions and exclusions that can impact your coverage decisions.

When it comes to understanding automotive insurance quotes, there are several key components to consider. These include the coverage options, factors that influence the cost of insurance, and how deductibles can impact premiums. Let's delve into these aspects in more detail:

When it comes to understanding automotive insurance quotes, there are several key components to consider. These include the coverage options, factors that influence the cost of insurance, and how deductibles can impact premiums. Let's delve into these aspects in more detail:

When looking at automotive insurance quotes, it is essential to understand what is included in the coverage to ensure you are adequately protected in case of an accident or other unforeseen events. Here we will delve into the key inclusions in automotive insurance quotes to help you make an informed decision.

When looking at automotive insurance quotes, it is essential to understand what is included in the coverage to ensure you are adequately protected in case of an accident or other unforeseen events. Here we will delve into the key inclusions in automotive insurance quotes to help you make an informed decision.

When it comes to determining automotive insurance quotes, several factors come into play. These factors can significantly impact the premium you pay for your coverage. Let's explore the key elements that influence automotive insurance quotes.

When it comes to determining automotive insurance quotes, several factors come into play. These factors can significantly impact the premium you pay for your coverage. Let's explore the key elements that influence automotive insurance quotes.