Beginning with Comparing Home and Auto Insurance Bundles: Are They Worth It?, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

When considering the value of bundling home and auto insurance, it's important to delve into various aspects that can impact your decision-making process.

Introduction to Home and Auto Insurance Bundles

When it comes to managing your insurance needs, bundling home and auto insurance policies can be a convenient and cost-effective option. Home and auto insurance bundles are packages offered by insurance companies that combine coverage for both your home and vehicles into a single policy.

This means you only have to deal with one insurer for both types of coverage, simplifying the process and potentially saving you money.

Benefits of Bundling Home and Auto Insurance Policies

- Cost Savings: One of the main advantages of bundling home and auto insurance is the potential for cost savings. Insurance companies often offer discounts to policyholders who choose to bundle their coverage, resulting in lower premiums overall.

- Convenience: Managing multiple insurance policies with one provider can streamline the process and make it easier to keep track of your coverage. You'll have one point of contact for any questions or claims, simplifying the administrative side of insurance.

- Increased Coverage Options: Bundling policies can also give you access to additional coverage options that may not be available if you purchase separate policies from different insurers. This can provide you with more comprehensive protection for your home and vehicles.

Examples of Insurance Companies Offering Bundled Policies

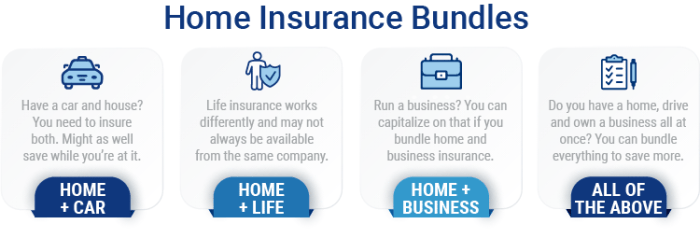

State Farm, Allstate, Progressive, and Geico are just a few examples of insurance companies that offer home and auto insurance bundles. Each company may have different bundling options and discounts available, so it's important to compare quotes and coverage details to find the best fit for your needs.

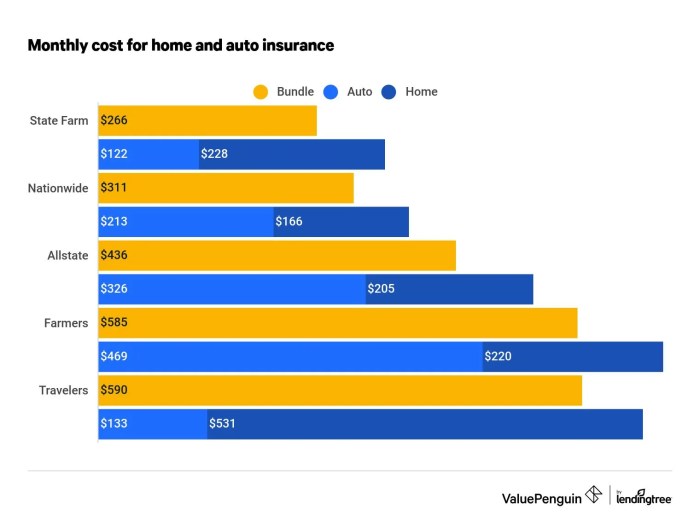

Cost Comparison of Bundled vs. Separate Policies

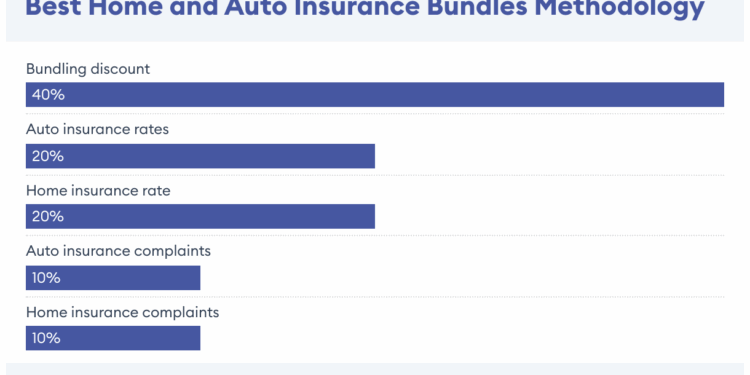

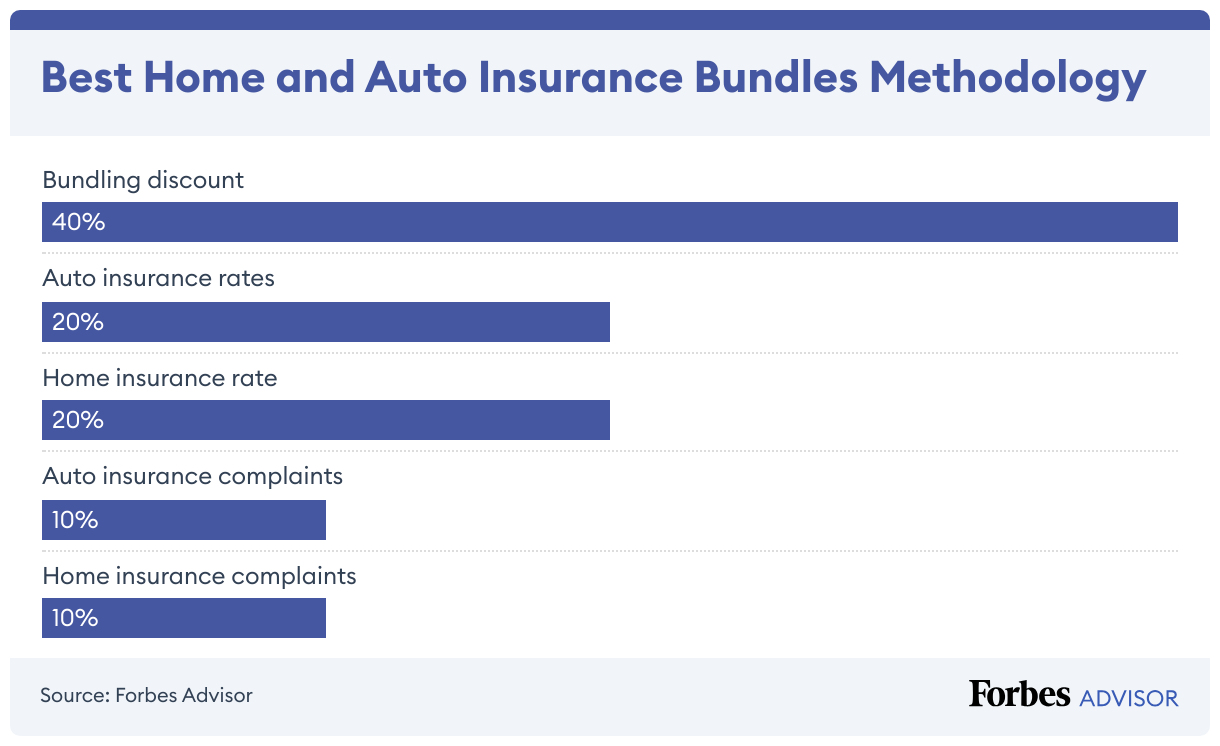

When it comes to insurance, understanding the costs associated with bundled and separate home and auto policies is crucial for making informed decisions. Let's break down the numbers to see if bundling is truly worth it for customers.

Breakdown of Costs

- Individual Home Insurance Policy: $X per month

- Individual Auto Insurance Policy: $Y per month

Total cost of separate policies: $X + $Y

Comparison of Bundled Policies

- Bundle Home and Auto Insurance: $Z per month

Potential cost savings: $X + $Y

$Z per month

Coverage Options in Bundled Policies

When it comes to home and auto insurance bundles, understanding the coverage options is crucial to determine if it's worth it for you. Let's take a closer look at the types of coverage typically included in these bundled policies and compare them with standalone policies.

Types of Coverage in Bundled Policies

- Liability Coverage: Bundled policies usually include liability coverage for both home and auto insurance. This protects you in case you are responsible for injuries or damages to others.

- Property Damage Coverage: Coverage for damage to your home and vehicle is commonly bundled together, offering comprehensive protection for your assets.

- Personal Property Coverage: Your personal belongings are typically covered under bundled policies, whether they are stolen from your home or car.

- Medical Payments Coverage: Bundled policies often include medical payments coverage, which pays for medical expenses for you and your passengers in case of an accident

.

Limitations and Restrictions

One common limitation of bundled policies is that you may not have the flexibility to customize coverage levels for your home and auto insurance separately.

- Some bundled policies may have restrictions on coverage limits or deductibles, which could impact your ability to tailor coverage to your specific needs.

- It's essential to review the fine print of bundled policies to understand any limitations or restrictions that may apply.

Comparison with Standalone Policies

- In standalone policies, you have the flexibility to customize coverage levels for your home and auto insurance independently, allowing for more tailored protection.

- Standalone policies may offer more options for additional coverage, such as umbrella policies or specific endorsements, which may not be available in bundled policies.

- While bundled policies can provide convenience and potential cost savings, standalone policies offer more control over your coverage choices.

Flexibility and Customization of Bundled Policies

When it comes to bundled home and auto insurance policies, customers have the flexibility to customize their coverage to suit their specific needs. This customization allows policyholders to tailor their insurance plans to provide the protection they require without paying for unnecessary coverage.

Add-Ons and Additional Coverage Options

- One common add-on option for bundled policies is umbrella insurance, which provides additional liability coverage beyond the limits of standard home and auto policies. This can be especially beneficial for those with significant assets to protect.

- Roadside assistance and rental car reimbursement are often available as add-ons for auto insurance in a bundled policy, offering peace of mind and convenience in case of emergencies or accidents.

- For home insurance, customers can opt for coverage for high-value items such as jewelry, art, or collectibles, which may not be fully covered under a standard policy.

Simplifying the Insurance Process

Bundling home and auto insurance can streamline the insurance process for customers by consolidating their policies under a single provider. This means dealing with only one insurance company for both policies, simplifying payments, renewals, and claims processing. Additionally, having bundled policies often makes it easier to track coverage and ensure there are no gaps in protection.

Customer Satisfaction and Reviews

When it comes to choosing between bundled or separate home and auto insurance policies, customer satisfaction and reviews play a crucial role in decision-making. Feedback from customers who have opted for bundled policies can provide valuable insights into the overall experience.

Feedback from Customers

- Many customers appreciate the convenience of having both home and auto insurance under one policy, simplifying the management of their coverage.

- Some customers have praised the cost-saving benefits of bundled policies, noting that they have saved money compared to purchasing separate policies.

- However, there have been complaints from some customers about limitations in coverage options or difficulties in customizing their bundled policies to meet their specific needs.

Customer Satisfaction Rates

Insurance companies offering bundled policies often tout high customer satisfaction rates as a selling point. These rates are typically based on surveys and feedback from policyholders.

It is important to note that customer satisfaction can vary greatly depending on individual experiences and preferences.

Closing Summary

In conclusion, the comparison between bundled and separate policies unveils intriguing insights that may influence your insurance choices. As you weigh the benefits and costs, the decision ultimately rests on what aligns best with your needs and preferences.

FAQ Corner

Are there discounts available for bundling home and auto insurance policies together?

Yes, many insurance companies offer discounts when you bundle your home and auto policies together, leading to potential cost savings.

What happens if I want to cancel one policy in a bundle?

If you decide to cancel one policy in a bundle, you may lose the discount associated with bundling, and your rates for the remaining policy could increase.

Can I customize my coverage when I choose a bundled policy?

Yes, bundled policies often allow for customization, letting you tailor your coverage to suit your specific needs.

Beginning with Comparing Home and Auto Insurance Bundles: Are They Worth It?, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

When considering the value of bundling home and auto insurance, it's important to delve into various aspects that can impact your decision-making process.

Beginning with Comparing Home and Auto Insurance Bundles: Are They Worth It?, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

When considering the value of bundling home and auto insurance, it's important to delve into various aspects that can impact your decision-making process.

When it comes to insurance, understanding the costs associated with bundled and separate home and auto policies is crucial for making informed decisions. Let's break down the numbers to see if bundling is truly worth it for customers.

When it comes to insurance, understanding the costs associated with bundled and separate home and auto policies is crucial for making informed decisions. Let's break down the numbers to see if bundling is truly worth it for customers.

When it comes to home and auto insurance bundles, understanding the coverage options is crucial to determine if it's worth it for you. Let's take a closer look at the types of coverage typically included in these bundled policies and compare them with standalone policies.

When it comes to home and auto insurance bundles, understanding the coverage options is crucial to determine if it's worth it for you. Let's take a closer look at the types of coverage typically included in these bundled policies and compare them with standalone policies.

When it comes to bundled home and auto insurance policies, customers have the flexibility to customize their coverage to suit their specific needs. This customization allows policyholders to tailor their insurance plans to provide the protection they require without paying for unnecessary coverage.

When it comes to bundled home and auto insurance policies, customers have the flexibility to customize their coverage to suit their specific needs. This customization allows policyholders to tailor their insurance plans to provide the protection they require without paying for unnecessary coverage.